HONGSA MINE MOUTH POWER PROJECT

PROJECT BACKGROUND

The Hongsa Mine Mouth Power Project

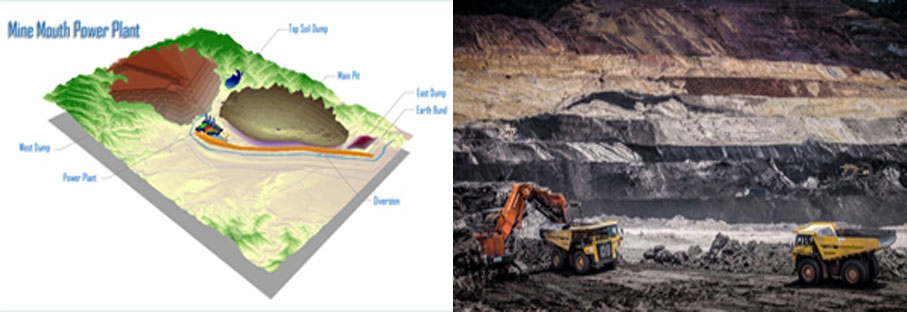

The project is located in Hongsa and Ngeune districts in Xayaboury province, Lao PDR. The project comprises a lignite-fired power plant, a lignite mine, a limestone mine, and supporting infrastructures. On 30 November 2009, HPC signed a Concession Agreement (CA) with the Government of Lao PDR to develop and operate the Power Plant and the mines. Under the agreement, 1,473 MW of electricity sell to the Electricity

Generating Authority of Thailand (EGAT) at the Thai-Lao border for a period of 25 years, while the remainder is

consumed locally.

The Power Plant usesapproximately 14.3 million tonnestonnes of lignite per year from the Hongsa Mine of which its lignite reserves were initially estimated at 436.9 million tonnes as the primary fuel.

The construction of the Power Plant has commenced since the end of 2010 and the construction is completed on the mid 2015.

Background

Thai – Lao cooperation in the power industry

Thai – Lao cooperation in the power industry has existed since 1998, with the Nam Theun - Hinboun hydropower project supplying 187 MW to the Thai national grid. Under the Inter-Government Memorandum of Understanding (MOU) signed in December 2007 between Thailand and Lao PDR, 7,000 MW of electric power was agreed to be supplied to Thailand by the year 2015. To fulfill the MOU agreement, the Hongsa Mine Mouth Power Project was developed to contribute to the power export capacity to Thailand. On 18 December 2006, the Government of Lao PDR (GoL) signed the Heads of Agreement (Project Development Agreement) on the Hongsa Lignite and Power Project with Banpu Power Limited (BPP) a wholly-owned subsidiary of Banpu Public Company Limited (Banpu). The Agreement granted BPP the right to conduct investigative studies to facilitate the construction of a lignite mine that would supply fuel to the 1,800 MW lignite-fired power plant is constructed on a 76.4 square-kilometer area in the Hongsa Valley; as well as to carry out the excavation of a limestone quarry, located 35 kilometers away from the Power Plant. On 10 June 2009, the Heads of Agreement (Project Development Agreement) on the Hongsa Lignite and Power Project was extended to 21 December 2009. Since then, BPP has developed the Project industriously together with Ratchaburi Electricity Generating Holding Public Company Limited (RATCH) and Lao Holding State Enterprise (LHSE).

Background

The Project completed in 2016 and will make Laos become widely renowned as the “Battery of ASEAN”, with its capacity to produce 1,473 MW of electricity for sale to the Electricity Generating Authority of Thailand (EGAT), and 100 MW to the Electricité du Lao (EDL), over a period of 25 years.Specific project benefits are as follows:

• Providing base-load electricity supply to both Lao PDR and Thailand

• Becoming a suitable model of achieving sustainable social and economic development

• Creating an improved standard of living, based on a steady stream of project revenues

• Offering employment opportunities and training programs for local communities

• Developing new infrastructure and facilities for local communities – including houses, roads, as well as education and health facilities

• Providing a relatively stable power tariff, not subject to world oil and gas prices

• Ensuring a highly reliable power supply, as the mine mouth power plant has no risk of fuel shortage

• Promoting bilateral economic relationship between Thailand and Lao PDR, and fulfilling the bilateral power purchase agreement between the two countries

Financing

A total finance package worth US$ 3.71 billionin capital commitments to HPC was proportionately contributed by 9 Thai commercial banks – namely, Bangkok Bank, Siam Commercial Bank, Krungthai Bank, Government Savings Bank, Kasikornbank, Export-Import Bank of Thailand, Bank of Ayudhya, Thanachart Bank, and TMB Bank. As for long-term senior debts under the typical limited-recourse project financing scheme, the financial close took place in August 2010; while the first drawdown was made in October 2010.

In addition to senior loan facilities, shareholders are committed to back-end equity injection.

Shareholder and Board of Directors

Banpu Power Public Company Limited

Banpu Power Public Company Limited

Banpu Power Public Company Limited (formerly Banpu Power Limited., the subsidiary of Banpu Public Company Limited) is registered to a public company

in Thailand on September 8, 2015 as a holding company of conventional and renewable power assets across Asia including Thailand, Laos, China, and Japan.

BPP has developed, operated and invested in power assets for more than 20 years. The company is regarded as the regional platform of highest international standards in both operations and corporate governance through its extensive proven experiences coupled with the emphasis on sustainability and social responsibilities.

RH International (Singapore) Corporation Pte., Ltd.

RH International (Singapore) Corporation Pte., Ltd.

RH International (Singapore) Corporation Pte. Ltd. is a subsidiary of RATCH Group Public Company Limited (formerly named as Ratchaburi Electricity Generating Holding Public

Company Limited) to operate the investment in power business internationally. The company was incorporated in 2010 and is based in Singapore.

RATCH Group Public Company Limited is a leading Independent Power Producer in Thailand, with an ambitious vision aiming to be a leading value-oriented integrated energy company in Asia-Pacific. Founded on 7 March 2000, the Company has the issued and paid-up capital of THB 14.5 billion and the Electricity Generating Authority of Thailand (EGAT) is its major shareholder with 45% equity stake.

Lao Holding State Enterprise

Lao Holding State Enterprise

Lao Holding State Enterprise (LHSE) is a 100% State Owner Enterprise established as a business company in conformity with the business Law and the Prime Minister's Decree.

The Lao Holding State Enterprise is invested solely by the Government of Lao PDR, represented by the Minister of Finance. The primary function of LHSE is to hold, manage and maintain on behalf of the Government of the Lao PDR shares in Nam Theun 2 Power company (NTPC) and any other Power Project Companies which are acquired by LHSE or transferred to it by the Government, in an efficient and businesslike manner. Current investment of LHSE are Nam Theun 2, Hongsa Power, Nam Ngiep1, Xe Pian - Xe Nam Noy.

HPC Board of Directors (as of October 2021)

|

|

|---|---|

|

|

|

|

|

|

|

|

|

|

Technical Information

Power Plant

The Power Plant’s functional specification

has been prepared by Pöyry Energy Limited. The design specification of the Power Plant reflects the performance required by the Electricity Generating Authority of Thailand’s Power Purchase Agreement (EGAT PPA), as well as the limitations imposed by the Environmental Impact Assessment (EIA).

The Power Plant

is designed to have a nominal gross rating of 1,878 MW, consisting of three 626 MW-generating units, with a net availableforsale power output of 1,653 MW. Of the net availableforsale power output, 1,473 MW is contracted to EGAT under the EGAT PPA, measured at the Thai-Lao border (the Thai Grid delivery point), and 100-175 MW to the Electricité du Laos (EDL) under the EDL PPA, measured at the Hongsa Town Substation (the Lao Grid delivery point); while the remaining is lost in the transmission.

The Power Plant operation

will be controlled and monitored from a fullyequipped central control room. Each powergenerating unit will be highly automated to ensure strict compliance with operating limits, and achievement of optimum performance, as well as to guarantee reliability and safety of the Power Plant. Additionally, the Power Plant will operate in compliance with the World Bank Environmental Guidelines 2007 (WBEG07).

Transmission Line

Transmission Line and Substations

In order to supply electricity to the Thai and Lao grids, a transmission line of approximately 183 kilometers was constructed. To supply electricity to the Thai grid, a 67km, 500kV double circuit overhead transmission line was built from the Power Plant to the Thai-Lao Border. To supply electricity to the Lao grid, an approximately 115km, 115kV double circuit overhead transmission line was built from the Power Plant to a substation near Hongsa Town, and then to the Luang Prabang 2 substation. Apart from the 500kV and the 115kV double circuit overhead transmission lines, the Hongsa Town and the Luang Prabang 2 substations also was constructed.

Coal Mine

Lignite is used as primary fuel; while diesel is used for startup, flame stabilization, and lowload operations.Lignite will be supplied from the Mine located adjacent to the Power Plant. A geological lignite resource figure of 577.4 million tonnes has been delineated within the Hongsa deposit to a 350meter depth below ground surface.

While a total lignite reserve of 436.9 million tonnes has been estimated, HPC plans to excavate a proven lignite reserve of approximately 370.8 millon tonnes. To excavate the identified lignite reserve, 1,250 million bank cubic metres (BCM) of overburden and interburden have to be removed, resulting in an average stripping ratio of about 3.4:1 (BCM:t). Assuming an average annual lignite production of 14.3 million tonnes, the reserve of the Hongsa opencast mine would last for 26 years of operations.

To secure the supply of lignite against any interruption to mining operations, lignite sufficient for 2 week’s operations is stockpiled at the stockyard, adjacent to the northeast of the Power Plant. The stockyard serves as not only a lignite supply buffer, but also a lignite quality blending ground. The lignite supply of the specified quality will be transported to the transfer tower behind the stockyard – the hand-off point between the Mine and the Power Plant – by the lignite reclaiming conveyor system with twin 100% duty conveyors.

Water Resource System

Water to be used in the Power Plant will come from the lakes located to the east and west of the Power Plant site. The water from the west lake will be used in the construction of the Power Plant, and will eventually become part of the runoff flow control system from the mine. The water from the east lake, to be sourced from Nam Ken and Nam Luok dams, will be used in the operation of the Power Plant. While water from the Nam Luok Dam, located southeast of the Power Plant, can be drawn by gravity; a pumping station has to be constructed to pump water from the Nam Ken Dam, located northeast of the Power Plant, to the Power Plant. At its full capacity, the east lake will be able to support at least 5 days of Power Plant operations.

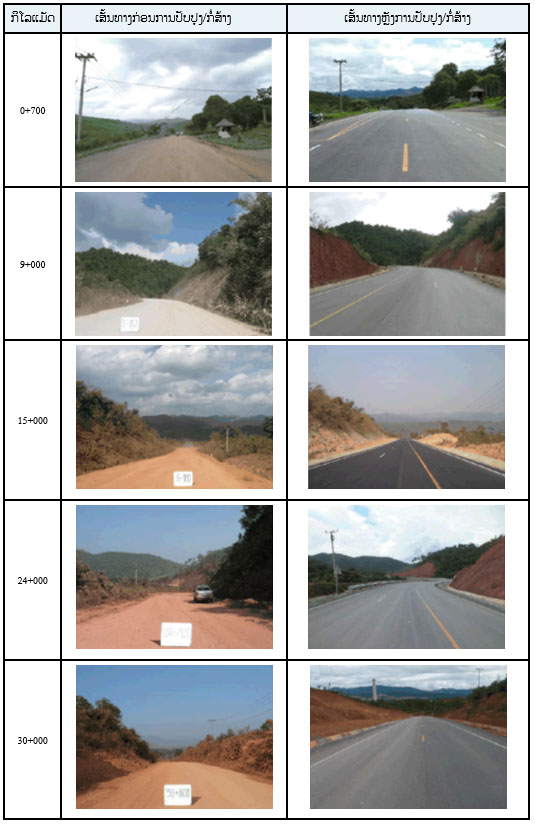

Road leading to/around the Project

Road AccessOverall, a road of approximately 62 kilometers will be constructed and upgraded. Out of the total length, 38 kilometers will be main roads to the Project, developed to standards of the Thai Department of Highways and the American Association of State Highway and Transportation Office; while the remaining 24 kilometers will be 3 access roads within the Project, leading to the Limestone Quarry, Nam Ken dam, and Nam Luok dam. Details of the roads to be constructed or upgraded are:

1. Main Road Linking Lao-Thai Border to the Power Plant 32 km

2. Ban Han Bypass Road (Hongsa district) 6 km

3. Access Road to Limestone Quarry (Ngeun district) 7 km

4. Access Road to Nam Ken Dam (Hongsa district) 12 km

5. Access Road to Nam Luok Dam (Hongsa district) 5 km

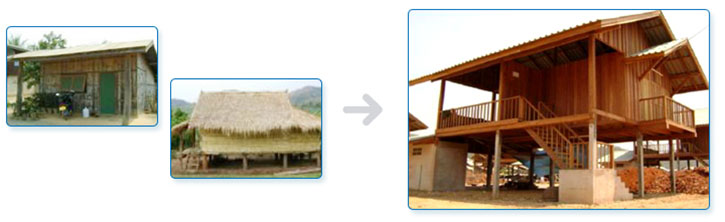

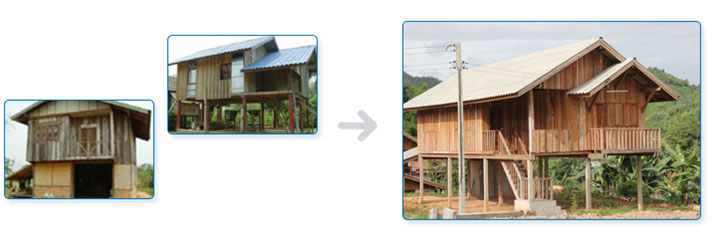

Resettlement Village

The Project’s social impacts are detailed in the Social Impact Assessment (SIA), and will be mitigated in accordance with the Resettlement Action Plan (RAP). Persons affected by the Project are relocated to 2 resettlement sites one at Na Balone and the other at Na Chan. Public facilities are constructed to cater for the relocated locals as well as the host communities. A budget of approximately US$ 31.8 million has been allocated for the implementation of the RAP, and for ensuring a better or at least a similar quality of life for the affected locals.

Type of Resettlement Houses

Production And Revenue Data

| Period | EGAT(GWh) | EDL(GWh) | Total(GWh) |

|---|---|---|---|

| Plan 2022 | 11,164.46 | 645.87 | 11,810.33 |

| Percentage(%) | 88.44% | 59.88% | 86.87% |

| 01/2022 | 833.97 | 38.53 | 872.50 |

| 02/2022 | 669.67 | 34.39 | 704.06 |

| 03/2022 | 1,020.16 | 63.05 | 1,083.21 |

| QuarterI | 2,523.80 | 135.97 | 2,659.77 |

| 04/2022 | 961.98 | 61.36 | 1,023.35 |

| 05/2022 | 1,018.67 | 48.99 | 1,067.66 |

| 06/2022 | 1,099.33 | 26.02 | 1,067.66 |

| QuarterII | 3,080 | 136 | 3,216 |

| 07/2022 | 1,095.37 | 27.35 | 1,122.72 |

| 08/2022 | 1,099.83 | 26.02 | 1,125.85 |

| 09/2022 | 1,126.09 | 29.20 | 1,155.29 |

| QuarterIII | 3,321 | 83 | 3,404 |

| TOTAL2022 | 73,918 | 3,199 | 77,116 |